The ISA has formulated principles and terms for initial public offerings of SPACs in Israel

25 May 2021

Dear clients and colleagues,

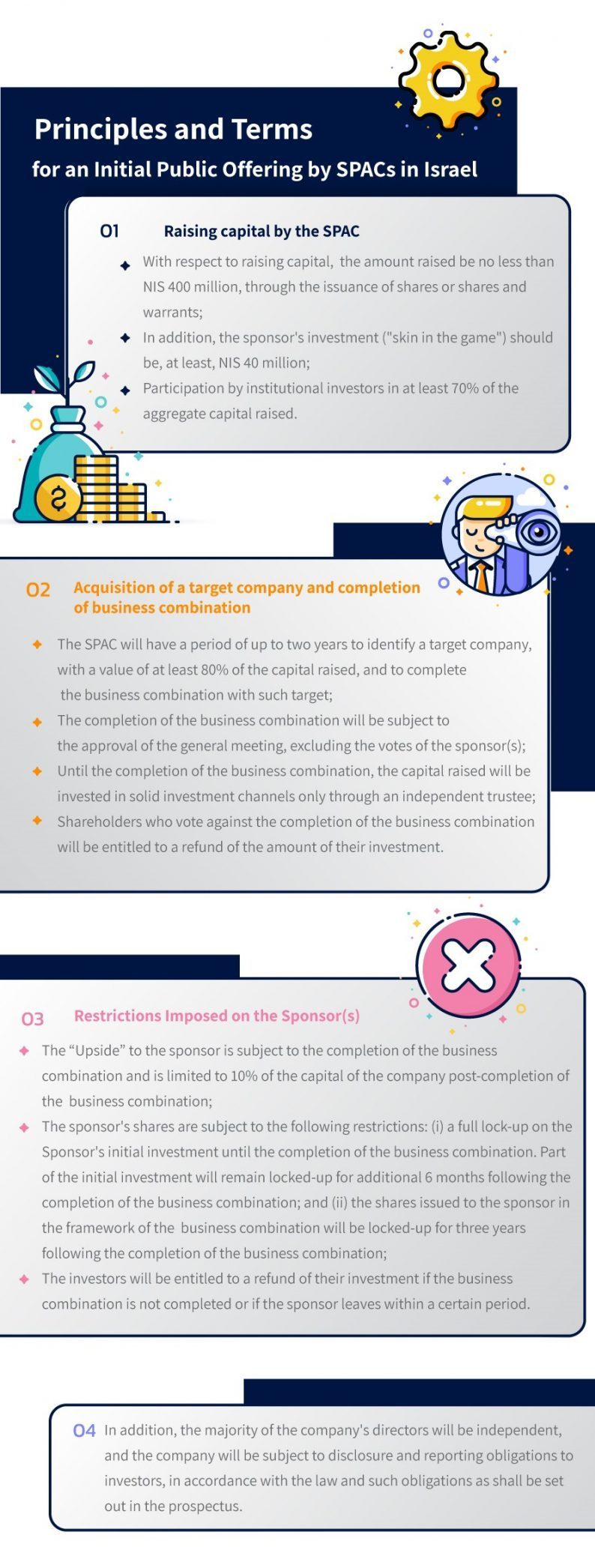

Recently, the Israel Securities Authority (“ISA”) published a list of principles and terms for the initial public offering of Special Purpose Acquisition Companies (“SPAC”). This is in light of the increasing global trend of SPACs initial public offerings.

The ISA has examined this issue during the past year, and has conducted thorough examination of the regulations on this matter in other international capital markets – particularly in Singapore, the United Kingdom and the United States. The ISA has formulated the following principles and terms with the aim to reinforce investors’ protection mechanisms:

The ISA is expected to approve prospectuses of sponsors who have experience in managing public funds and who meet the criteria listed above. In addition, the ISA holds discussions with with the Tel Aviv Stock Exchange Ltd. (“TASE”) in order to incorporate these criteria in the TASE Rules and Regulations.

Our firm has extensive experience in M&A transactions, securities law, corporate governance and capital markets regulation, including specific and extensive expertise in advising on business combinations with SPACs and public offerings by SPACs. We are at your disposal for any questions or clarifications relating to these matters.

Corporate, Securities and Capital Markets

Herzog Fox & Neeman

To contact us >>click here